2018 PCCA Contractor Survey Results

PCCA emailed its 2018 PCCA Contractor Survey on February 9 and emailed a reminder on February 20. Fifty-six contractor members responded. Following are the survey results.

(Click on chart thumbnails to open a new window with full-size images.)

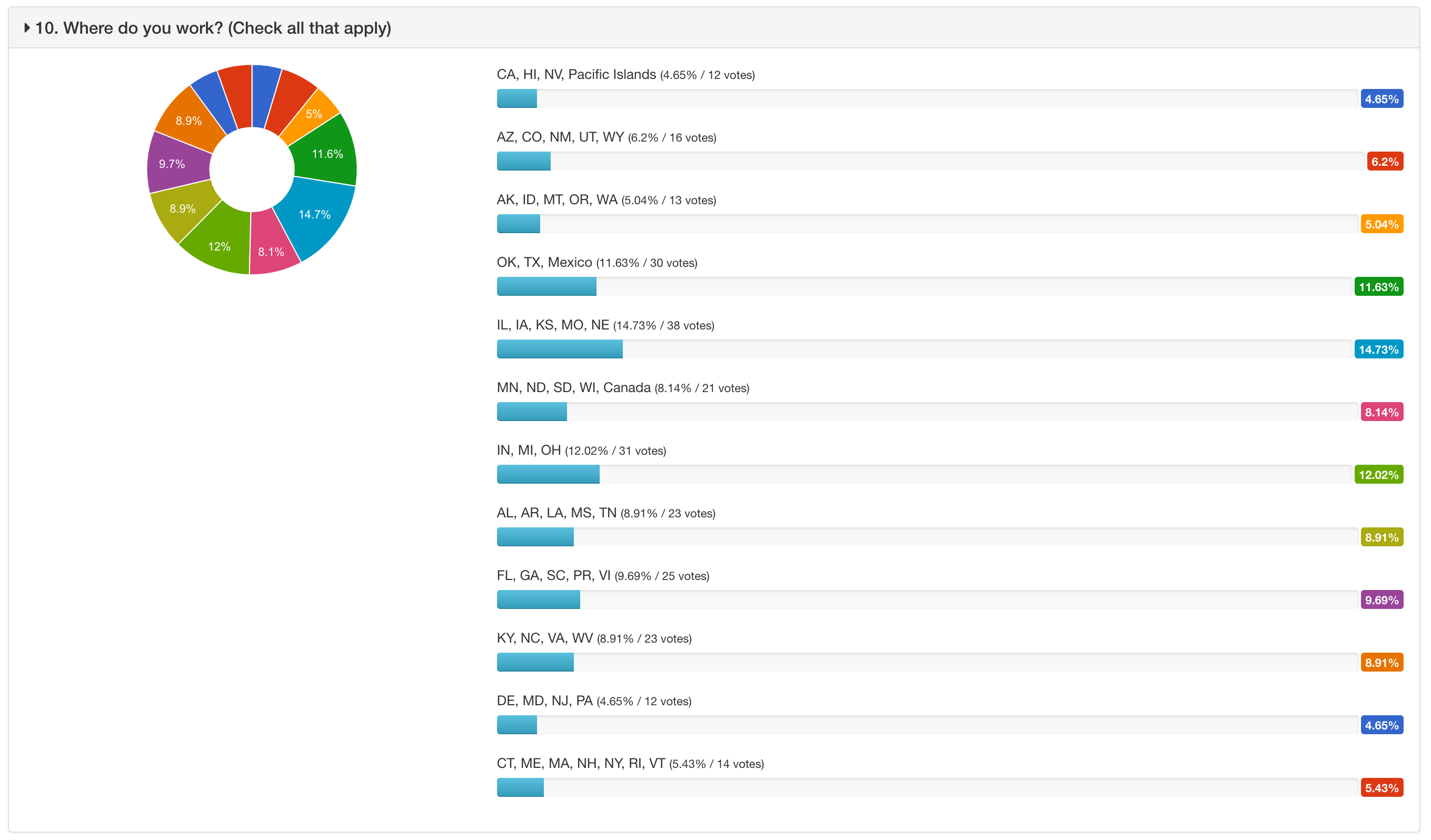

1. What trend in workload does your company see for the next 3, 5, and 7 years?

a. Up more than 10 percent

b. Up 5 percent

c. Neutral

d. Down 5 percent

e. Down more than 10 percent

PCCA contractors are very optimistic about their workload, especially in the near term. Nearly 93 percent see their workload increasing by 5 percent over the next three years, with two-thirds of those expecting increases of more than 10 percent. Over the next 5 years, 77 percent expect workload increases of more than 5 percent, with a third of those expecting increases of more than 10 percent. Nearly half (46.4 percent) of respondents replied "neutral" for their expected workload in 7 years, though an almost equal number (48.2 percent) expect gains of more than 5 percent.

2. Do you have any concerns about lead times with any products or services?

a. If yes, what products/services, and what do you see as a solution?

Nearly half of responding contractors (48.2 percent) have concerns about lead times on products or services. Among those with concerns, fiber is by far the product that causes the most concern, with 55 percent mentioning it. More than 22 percent mentioned equipment/trucks, and 7 percent cited aerial equipment. Most respondents didn't offer up any solutions, but a few said suppliers should increase their production/inventory and slightly fewer said that contractors should place orders based on forecasts.![]()

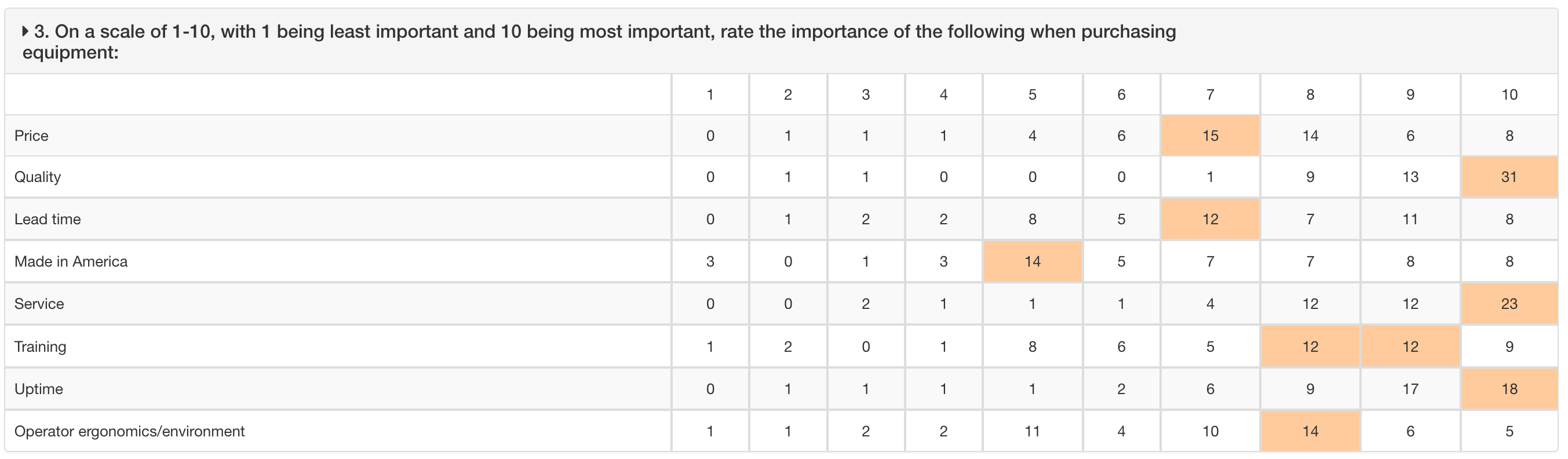

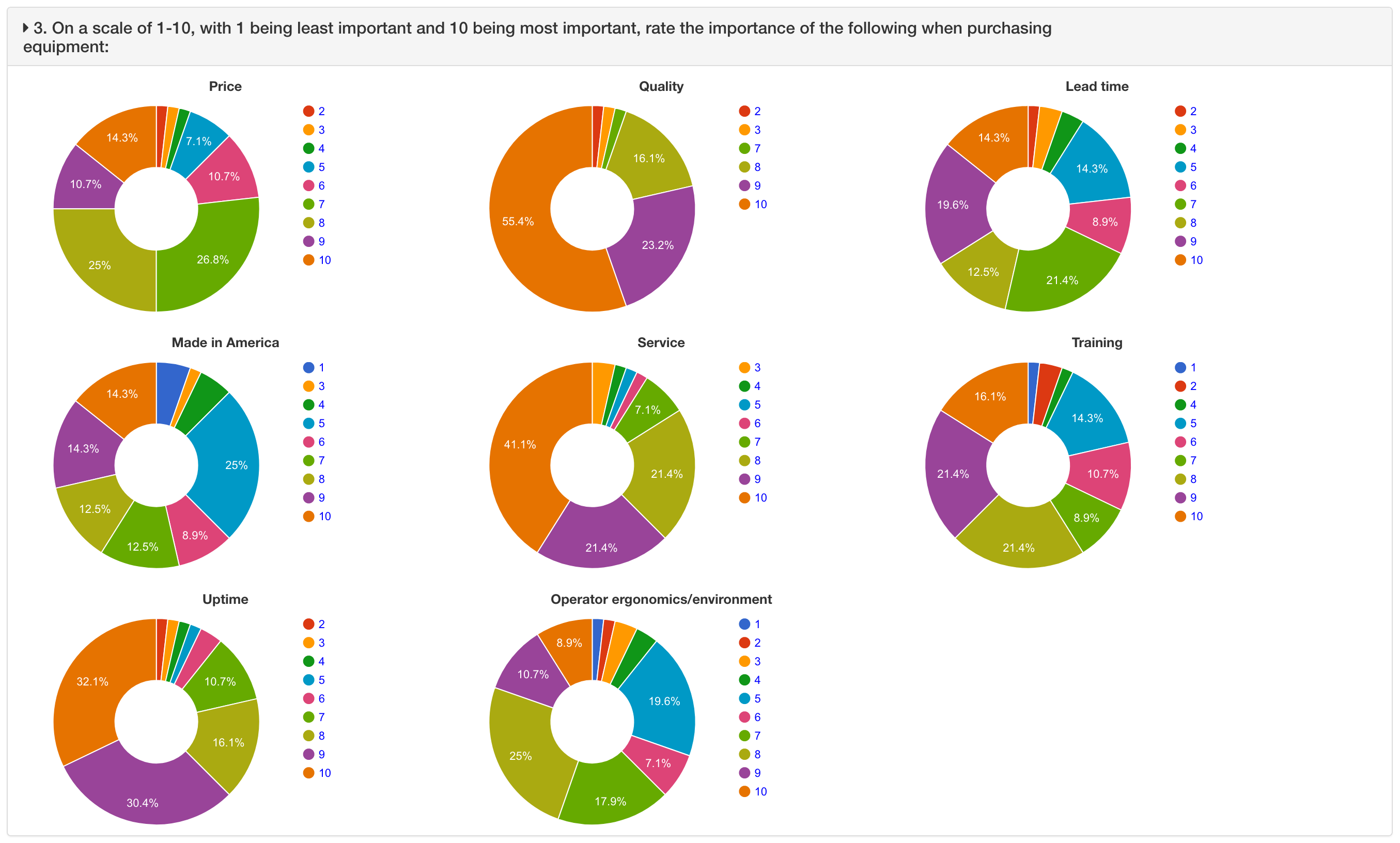

3. On a scale of 1-10, with 1 being least important and 10 being most important, rate the importance of the following when purchasing equipment:

a. Price

b. Quality

c. Lead time

d. Made in America

e. Service

f. Training

g. Uptime

h. Operator ergonomics/environment

When purchasing equipment, contractors said the most important factor was quality (mean: 8.71), followed by service (8.39), uptime (8.11), price (7.53), lead time (7.53), training (7.11), operator ergonomics/environment (6.66), and made in America (6.39).

4. Do you believe aftermarket services will start to become more important in the purchase decision than the products/services themselves in the future? Yes or No

Nearly 60 percent of responding contractors said that in the future aftermarket services will become more important in the purchase decision than the products/services themselves.

![]()

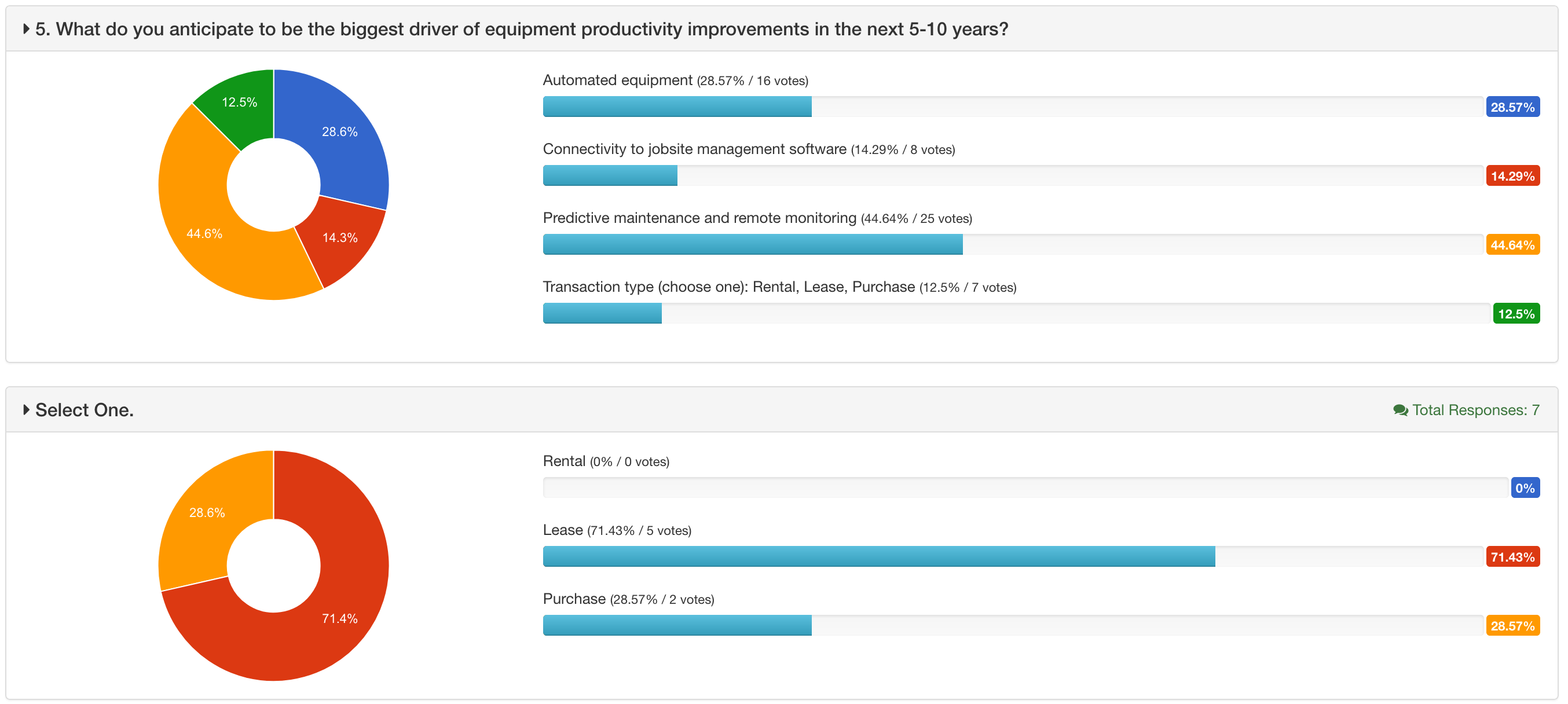

5. What do you anticipate to be the biggest driver of equipment productivity improvements in the next 5-10 years?

a. Automated equipment

b. Connectivity to jobsite management software

c. Predictive maintenance and remote monitoring

d. Transaction type (choose one): Rental, Lease, Purchase

Nearly 45 percent of respondents said that predictive maintenance and remote monitoring will be the biggest driver of equipment productivity improvements in the next 5-10 years, followed by automated equipment (29 percent) and connectivity to jobsite management software (14 percent).

6. Where do you see the trend moving?

a. More remediation

b. More new infrastructure

Nearly three-quarters of respondents (73.2 percent) see the trend moving more toward new infrastructure.![]()

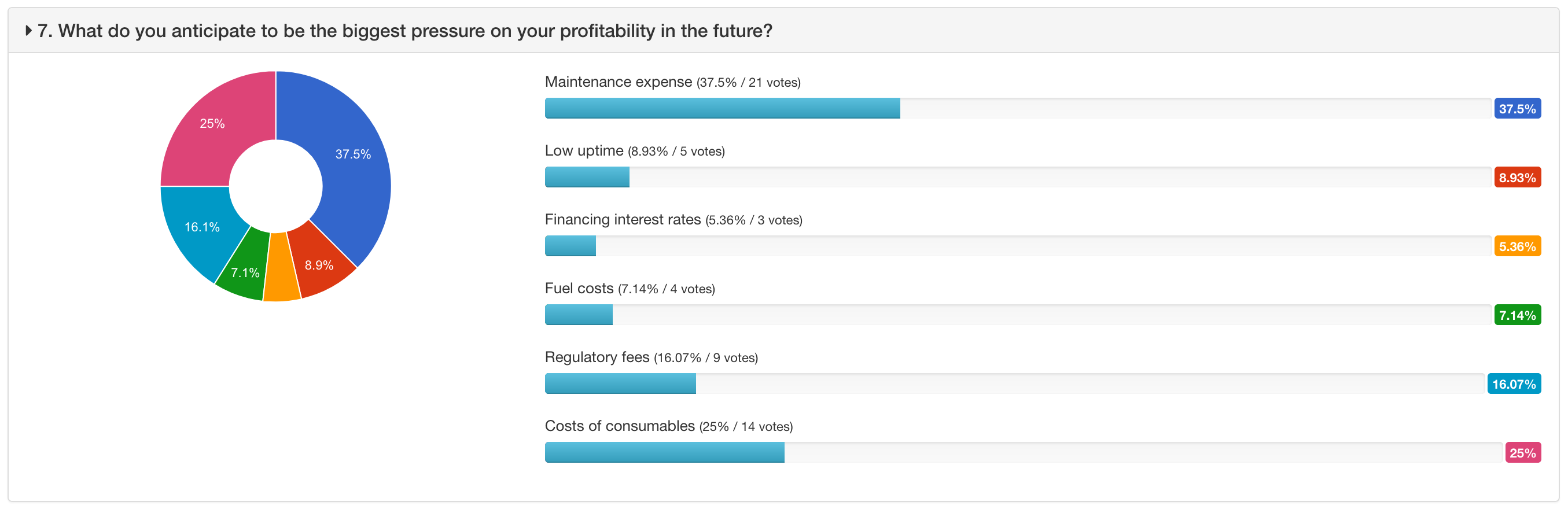

7. What do you anticipate to be the biggest pressure on your profitability in the future?

a. Maintenance expense

b. Low uptime

c. Financing interest rates

d. Fuel costs

e. Regulatory fees

f. Costs of consumables

With regard to equipment, 37.5 percent of respondents anticipate maintenance expense to be the biggest pressure on profitability in the future, followed by costs of consumables at 25 percent, regulatory fees at 16 percent, low uptime at 9 percent, and fuel costs at 7 percent.

8. In the next 3, 5, and 7 years, do you see more Transmission, Distribution, or Telecom work in your future?

While contractors see more Telecom work in the near-term, the amount of Distribution work increases with each 2-year increment that was asked about.![]()

9. Do you see more overheard or underground work in the next 3 years, 5 years, 7 years?

The responding contractors see the amount of underground work increasing with each 2-year increment in the question, from 51.8 percent of work in 3 years to 58.9 percent in 5 years to 62.5 percent in 7 years.![]()

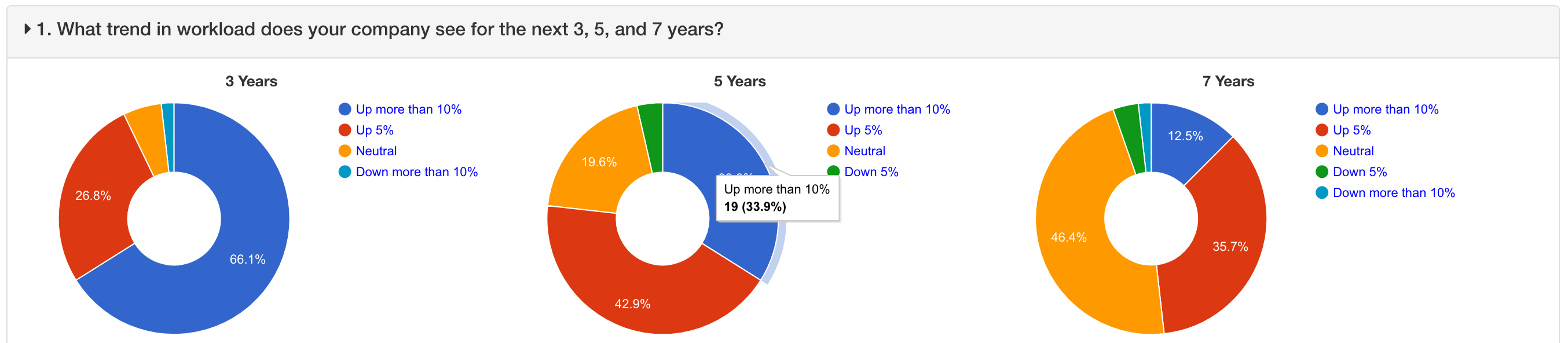

10. Where do you work? (Check all that apply)

a. CA, HI, NV, Pacific Islands

b. AZ, CO, NM, UT, WY

c. AK, ID, MT, OR, WA

d. OK, TX, Mexico

e. IL, IA, KS, MO, NE

f. MN, ND, SD, WI, Canada

g. IN, MI, OH

h. AL, AR, LA, MS, TN

i. FL, GA, SC, PR, VI

j. KY, NC, VA, WV

k. DE, MD, NJ, PA

l. CT, ME, MA, NH, NY, RI, VT

PCCA received responses from contractors working in every region of the country. (Respondents were instructed to check all of the regions where they work.) The highest number of responses (38) came from the region that includes Illinois, Iowa, Kansas, Missouri, and Nebraska, and the fewest (12) came from the region with California, Hawaii, Nevada, and the Pacific islands and the region with Delaware, Maryland, New Jersey, and Pennsylvania.